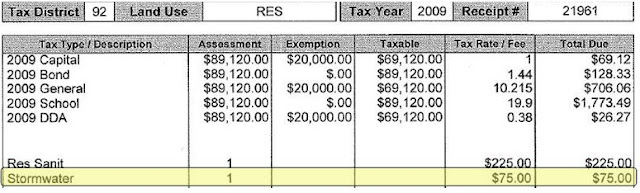

Stormwater fees

When it comes to City stormwater fees, everybody pays. Even tax-exempt property such as churches, DeKalb County property, and MARTA are required to pay stormwater fees to the City of Decatur. Even the City of Decatur pays stormwater fees to itself for the roads and other City-owned property!

But how are stormwater fees calculated? The stormwater fee for 2009 was $75 per “ERU”—an acronym that refers to the quantity or amount of impervious surface at your property. Impervious surface such as pavement leads to run-off that has to be drained by the City’s stormwater infrastructure. A single-family dwelling is “assessed” at a quantity of 1 ERU. Larger properties are charged a proportionately increasing ERU figure. For example, an office building with a parking deck may have more than 50 ERUs.

To see how many stormwater units you are paying for, look at this portion of your last tax bill:

For questions about the City’s stormwater policies, please contact the City’s Stormwater Utility.

Celebrating Georgia Arbor Day in Decatur

2 weeks ago

No comments:

Post a Comment