What could be more romantic this weekend than using some of Catherine’s

Valentine’s ideas and having a nice, romantic conversation about joint property ownership arrangements over dinner?

I’ve done some research on how many properties in Decatur have more than one owner, but before addressing that, I’ll give some background on co-ownership options.

If you own your home with another person using

joint tenancy with right of survivorship, that means that if you die, your spouse or partner automatically inherits your property. Georgia property law says that to create an arrangement like that, the deed must refer to the co-owners “as ‘joint tenants,’ ‘joint tenants and not as tenants in common,’ or ‘joint tenants with survivorship’ or as taking ‘jointly with survivorship’” (O.C.G.A. §44-6-190).

Tenancy in common, on the other hand, means that the co-owner wouldn’t automatically inherit the property: the property would go to the deceased owner’s heirs, and that process would go through probate. Georgia law says, “a tenancy in common is created wherever from any cause two or more persons are entitled to the simultaneous possession of any property. Tenants in common may have unequal shares” (O.C.G.A. §44-6-120).

Obviously, there are also cases where only one of the spouses or partners own the home, and only one name appears on the deed.

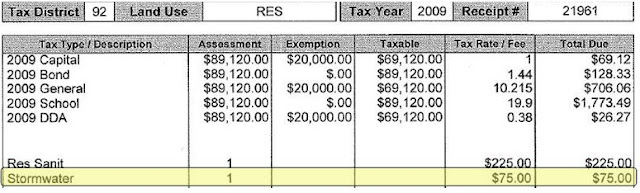

Now for the numbers. Deeds are filed with the DeKalb County, and property data is transmitted by the DeKalb County Tax Commissioner annually to us in the City of Decatur. Based on that digest we receive, there were 7,002 residential properties in the City of Decatur in 2009.

Of those, 3,441 properties are listed as having more than one owner, or 49 percent of homes.

Of those 3,441, there are 1,904 owners listed using the word “OR,” (for example, "SMITH JOHN OR SMITH JANE) suggesting tenancy in common. There are 235 properties using the letters “JT” (e.g., SMITH JOHN JT JANE SMITH JT) signifying joint tenancy with survivorship. The remaining 1,302 just list both names. Mind you, these numbers are based on the information I receive in the tax digest, and on tax bills we only print the first name listed. The

DeKalb County Clerk of Superior Court can verify whether two names are actually on the deed and what type of ownership arrangement was recorded.

If you’re concerned about the type of ownership you share, I would encourage you to talk it over with your loved one, seek the advice of an attorney if you’re making a change, and check with DeKalb County for filing procedures.