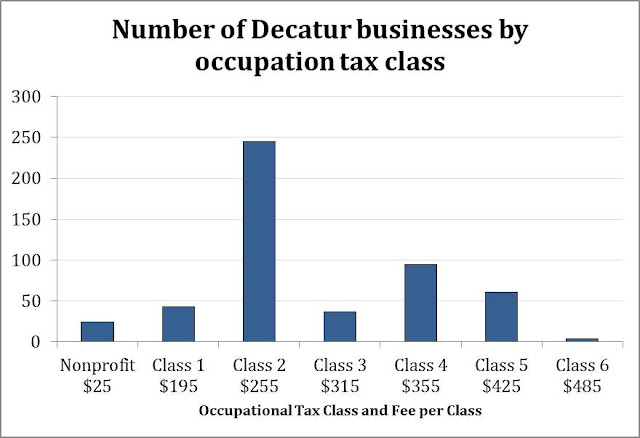

Although some businesses in Decatur are required to pay up to $485 per year for

their business license, the majority of local businesses are charged a $230

occupational tax plus a $25 administrative fee as “Class 2” businesses under the

city’s occupation tax ordinances. About 245 of Decatur’s 510 local businesses

(excluding home-based businesses, professionals such as doctors and architects,

and insurance carriers) fall under Class 2, which includes most restaurants and

many retailers.

The city’s occupational tax rates are based on

profitability ratios. The concept is

that, generally speaking, businesses in lines of work that are more profitable

are expected to pay a higher occupation tax rate that businesses that are less

profitable.